FILING YOUR INSURANCE CLAIM

How to File a Roof Damage Insurance Claim in Texas:

A Homeowner’s Guide

A Homeowner’s Guide

Texas weather can be unpredictable—hailstorms, high winds, and heavy rain often leave roofs battered. If your roof has been damaged, filing an insurance claim quickly and correctly can make all the difference.

Most Homeowners' Insurance Policies cover hail and wind damage. Review your policy thoroughly. Here's a step-by-step guide to help you navigate the process and protect your investment.

If you have any questions about the process, we'll be happy to help!

message us At roofconviviendo@gmail.com

Keep Your home protected

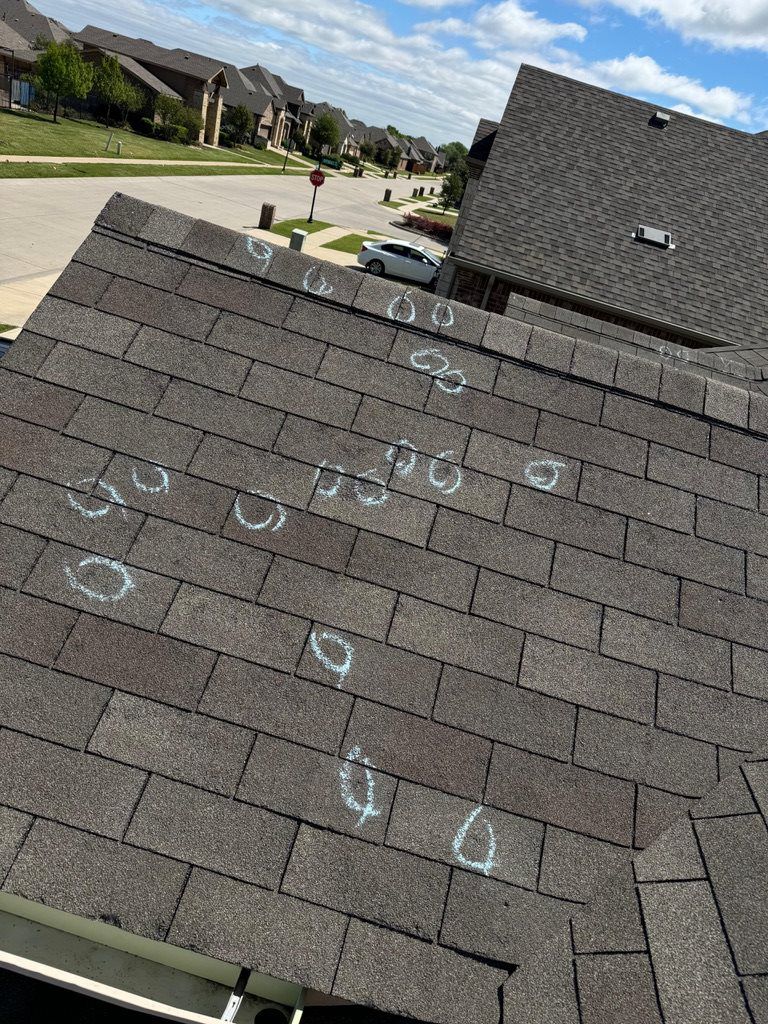

1. Document the Damage

Take clear, timestamped photos of all visible damage, including missing shingles, leaks, dents, or debris.

Include wide shots of the roof and close-ups of specific areas of concern.

If safe, inspect the attic for signs of water intrusion.

2. Review Your Homeowners' Insurance Policy

Understand your deductible and whether your coverage is for replacement cost or actual cash value.

Look for exclusions—some policies don’t cover cosmetic damage.

3. Contact Your Insurance Company Immediately

Most policies require claims to be filed within a time frame

Provide your policy number, damage description, and photos.

Ask if you can make temporary repairs and what documentation is needed.

4. Prevent Further Damage

Use tarps or plywood to cover exposed areas.

Keep receipts for emergency repairs—they may be reimbursed.

This step is often required by your policy to avoid claim denial.

5. Schedule a Professional Roof Inspection

Call or message us to help with any questions you may have about your insurance claim or roof evaluation.

Get a written estimate and compare it with the insurance adjuster’s report.

6. File the Claim and Submit All Documentation

Include photos, inspection reports, and receipts.

Keep a log of all communications and updates.

7. Complete Repairs and Finalize the Claim

Submit final invoices to your insurer.

Keep all records for future reference or warranty claims.